The company can convert the amount owed to notes payable to avoid legal disputes. This typically happens when the company discovers it may not fulfill short-term debt commitments. It's possible to convert accounts payable to notes payable after both borrower and creditor agree.

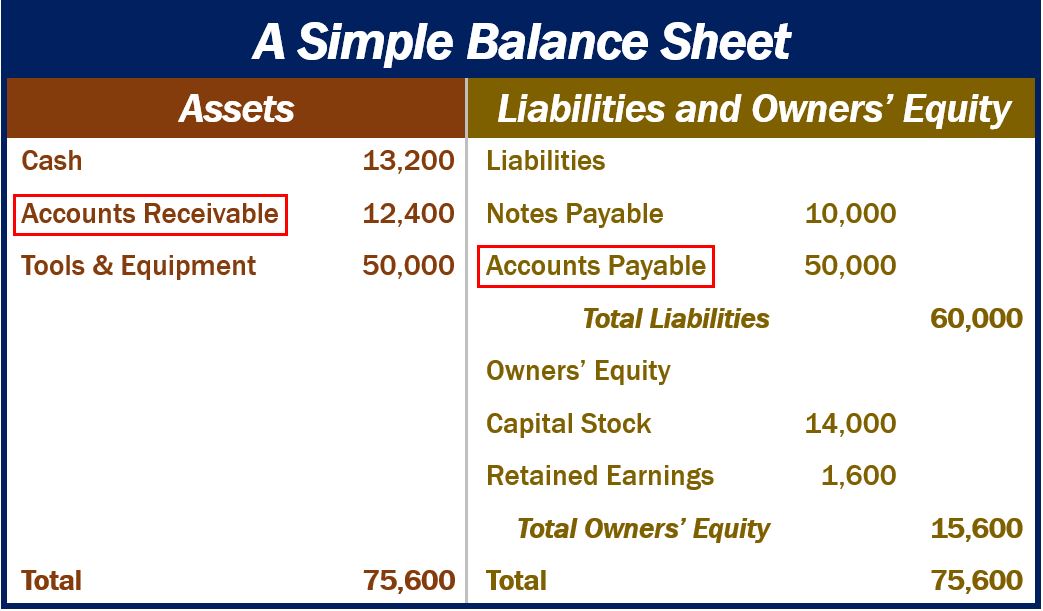

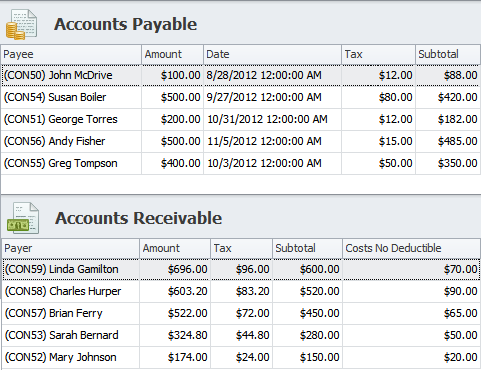

Notes payable may be binding, especially when it involves a formal contract with a written promise that can act as proof that the borrowing company has a loan. Businesses purchase supplies and services on credit and then pay the debt amount within a promised time, usually ending within a year. The business and creditor verbally agree on the repayment deadline in accounts payable. There is no written agreement in accounts payable between a business and its creditors or vendors, while companies use a promissory note as a written agreement in notes payable. Here are the key differences between notes payable and accounts payable: Written agreements The following are some items purchased under accounts payable:ĭifference between notes payable and accounts payable Whenever its accounts payable increases, the company makes many purchases and pays for utilities, using more credit than cash. Managing accounts payable efficiently helps manage a company's cash flow. Read more: What Is Accounts Payable? (Required Duties and Skills) What is the function of accounts payable? Businesses can maintain accurate accounts payable accounts as it helps the credit rating of the company, cast position, and reliability to lenders and vendors. Some companies may settle their accounts payable within a year to record it as part of present liabilities in the balance sheet. Like notes payable, accounts payable is also a liability account with a credit balance. Related: What Is a Balance Sheet? FAQs, Components, and an Example What is accounts payable?Īccounts payable refers to an account used to document any goods and services the company buys using loans. On a company's balance sheet, a debt recorded as notes payable may include the following accounts: This may mean that the company's total balance of the notes payable account may be a liability in the company's balance sheet. Most promissory notes usually last a year. When viewing the notes payable account, the company sees a representation of the total amount of money left to repay against the notes the company issued. The business credits the notes payable account while it debits assets or cash against it. The firm's account acts as a liability account.

Notes payable monitors all promissory notes created by the business to lenders or vendors. Notes payable contain the following information:Īmount to be repaid in terms of the promissory noteĭepending on the business, you can use notes payable for daily tasks such as buying materials in bulk from suppliers, purchasing equipment, buildings, and machinery, and loaning a substantial amount of money from a bank or other financial institution. The promissory note may specify the exact date the interest rate and limitations may mature. When the borrowing company officially submits the promissory note, it's making an unconditional guarantee to refund the lender or financial institution for the amount owed or asset given. It may then issue a promissory note to a lender, government, bank, or vendor to borrow the needed capital to complete the merger or acquisition. For example, a company may lack sufficient funds to transact during a merger or acquisition. The company keeps the account as part of the firm's general accounting ledger in a written agreement to repay a fixed amount of money within the set timeline. Notes payable is the type of account that a lender gives a company to hold to repay money borrowed. By optimizing notes payable and accounts payable, a business can ensure that it receives more than enough cash to cover its expenses. Late payments often cause severe cash flow problems. This can eventually help the company have better financial stability, which can attract investors.

WHATS MORE LIQUID NOTES PAYABLE OR ACCOUNTS PAYABLE HOW TO

It can also help you learn how to lower the risk of short-term loan default and increase the firm's debt capacity. accounts payable can help you understand business growth, finance business activities, and generate better profit margins. In this article, we define notes payable vs accounts payable, explain their importance, discuss the primary differences, and answer some frequently asked questions.

Understanding the meaning of notes payable and accounts payable can help you gain significant knowledge in finance, advance your career, and perform accounting more efficiently. Both financial terms handle how finance professionals record funds. Notes payable and accounts payable are two terms you might use in accounting.

0 kommentar(er)

0 kommentar(er)